Citizens, beware. The proposed Sierra County Arroyo Flood Control District would add another taxing district and set of five elected officials to the layers of local government.

This is a county with mostly Republican voters, with mostly Republican elected officials. What happened to limiting, not expanding government?

Besides, we already have a flood control tax and flood control administration system. True, it needs more transparency and public outreach than currently exists to be effective and equitable, but if it were run right it offers better checks and balances and protection to taxpayers than the proposed flood control taxing district, which I will write about in a later article.

I fear this new taxing district will be promoted without any mention of property taxes, forcing ignorance onto voters. That’s what elected officials and local leaders did when they were trying to create a hospital taxing district. No mention of taxes, just the “unwieldy” number of board members (21), and how a hospital district would reduce that number to five, and those would be elected and therefore somehow more responsive than the elected officials advocating for the change. Twice local leaders failed to get the requisite number of petition signatures to get the question on the ballot. Voters didn’t buy the story, and since then nothing has been done to reduce the unwieldy number of board members, proving that wasn’t the real point of the initiative.

The point of the hospital district was to raise hospital revenue to pay off debt. The elected officials bought too much new hospital in 2016, the debt payments exceeding tax revenue the people already pay. A hospital taxing district would have added another property tax on top of the existing property and gross receipts taxes.

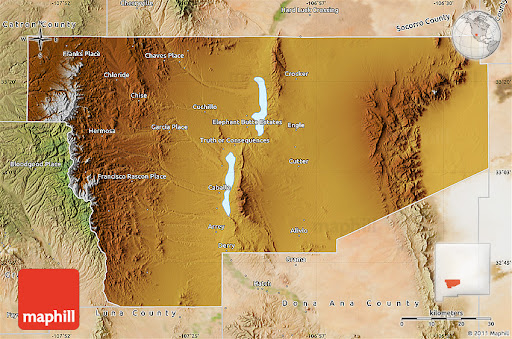

I fear that this is also what the Sierra County Arroyo Flood Control District is about—adding another tax on top of the current flood control tax, which is $1.50 per $1,000 assessed property value for incorporated and unincorporated areas in the county. That brought in a little over $500,000 in 2023, according to the county’s 2023 yearly audit, which is available on the State Auditor’s website. The county had a total of $2.9 million in the flood control tax fund as of June 30, 2023. If anyone recalls that money going to municipalities—Truth or Consequences, Elephant Butte and Williamsburg—please comment on this article. I don’t think any incorporated area received the benefit of this tax money. Elected officials from those municipalities should have complained about it until the money was distributed equitably.

The proposed district, if it passes at the polls, would impose another $.50 per $1,000, which could go up to $2.00 if voters approve the increases. The new district can also take on debt with voter approval, which would add more tax to pay it off. The debt tax has no limit or cap imposed by the state. A majority of voters blithely approve general obligation bonds every three years or so for the school district with no information and probably without knowing it will very likely increase property taxes. That’s why the school district’s debt tax is $5.65 per $1,000 in addition to the state-defined $1.99 capital improvements and $ .50 operations taxes.

Although the lack of voter signatures kept the hospital district off the ballot, state law allows the county commission to do an end-run around voters for a flood taxing district. You need 10 percent of voters’ signatures on a petition to the district court or the city commission may ask the district court to put the question of a flood district on the ballot.

County commissioners could have drummed up grass roots support for this taxing district, submitting a petition with voters’ signatures to the court. Instead, they petition the court directly in April, calling no town hall before or since.

The court case will be held at 1:30 p.m. on June 21, at district court on 3rd and Date streets, but I will likely not attend since it will be a pro forma public hearing. State law requires that the judge check and confirm that the petition includes the name of the proposed district, the facilities to be acquired or improved, the district boundaries and “a prayer for the organization of the district,” as stated in state statute 72-18-5.

I emailed County Commissioners Jim Paxon, Travis Day and Hank Hopkins about a week ago, as well as current Flood Commissioner Sandy Jones. I asked two questions, one of which was whether the current $1.50 property tax will stay in place if the Sierra County Arroyo Flood District passes Nov. 5. No answer.

Their silence is another reason to suspect this top-down initiative. They should be talking now, they should be holding town halls now to inform the citizens of this new taxing district. If the court approves the ballot question (in less than three weeks), then county commissioners risk violating election laws by talking about it. Evidently Paxon, Day and Hopkins prefer to keep citizens uniformed, perhaps relying on low-information voters to pass the measure on simple faith, not facts. Such voters don’t question their leaders.

Very helpful article. It sounds like the June 21 hearing will not take any public testimony — I had hoped it would. I do not look forward to getting into another double taxation situation. Poor residents of Sierra County already pay twice to help the Spaceport – once through our regular State taxes and a second time through a 1/4 percent gross receipts tax mostly dedicated to supporting the Spaceport.

I live in a rural part of Sierra County and don’t really expect much in terms of flood control facilities, but I still don’t recall seeing much, if anything, happening with flood control money in our area. A bridge over the frequently flooded Highway 52 at Winston would be a nice thing. It is very dangerous and two years ago the County lost an expensive truck trying to cross the creek during a flood event. (Yes, I know it is a NMDOT facility, but some intergovernmental cooperation would be nice!). The County Road Department has been critical in terms of keeping flooded roads open, but I don’t think that uses flood control money.